Get investment ready

Prepare, structure, and complete your fundraise - we won't take a cut of your round!

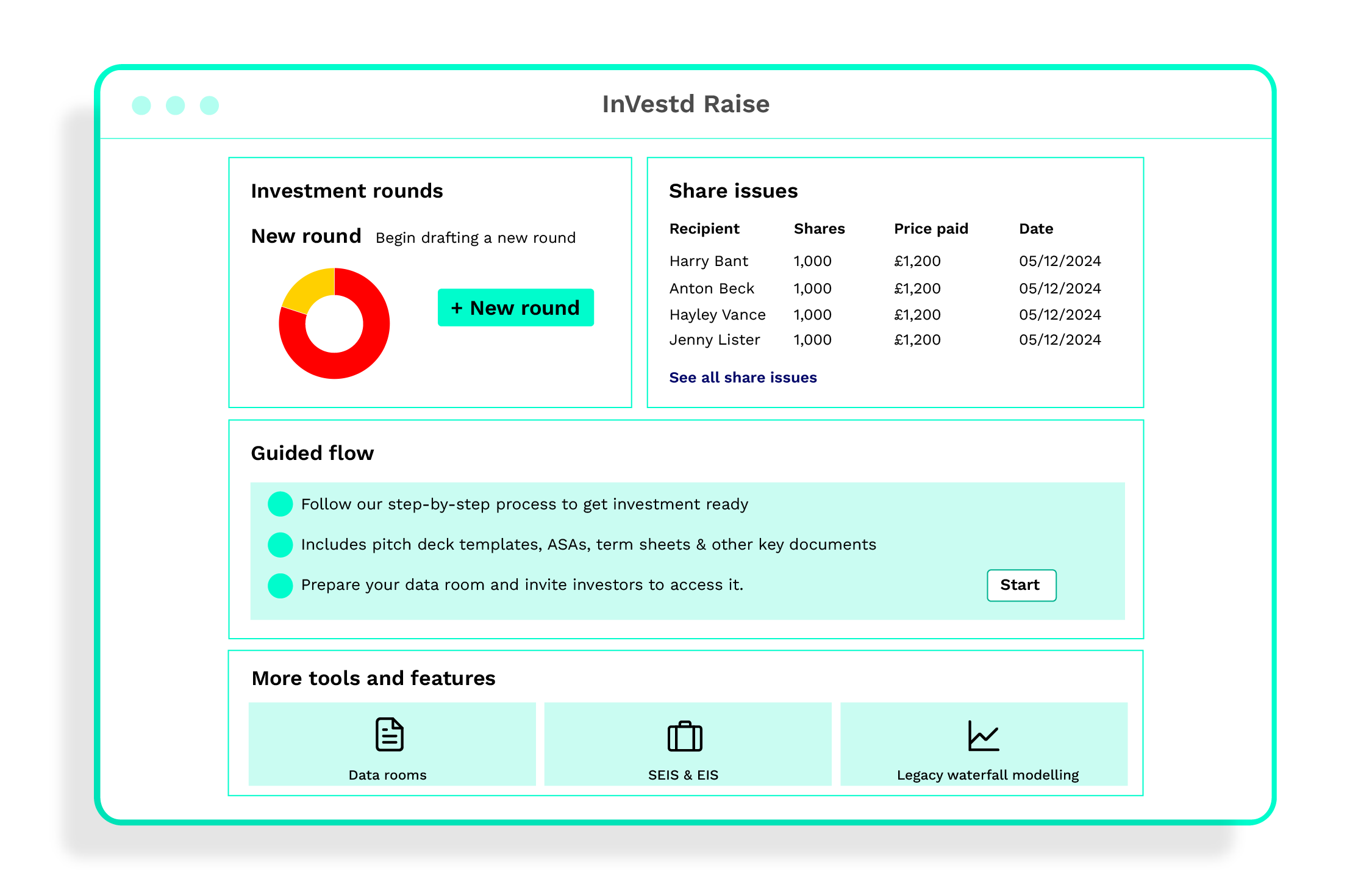

The digital platform to manage your raise

Tools, templates and plenty of expert support

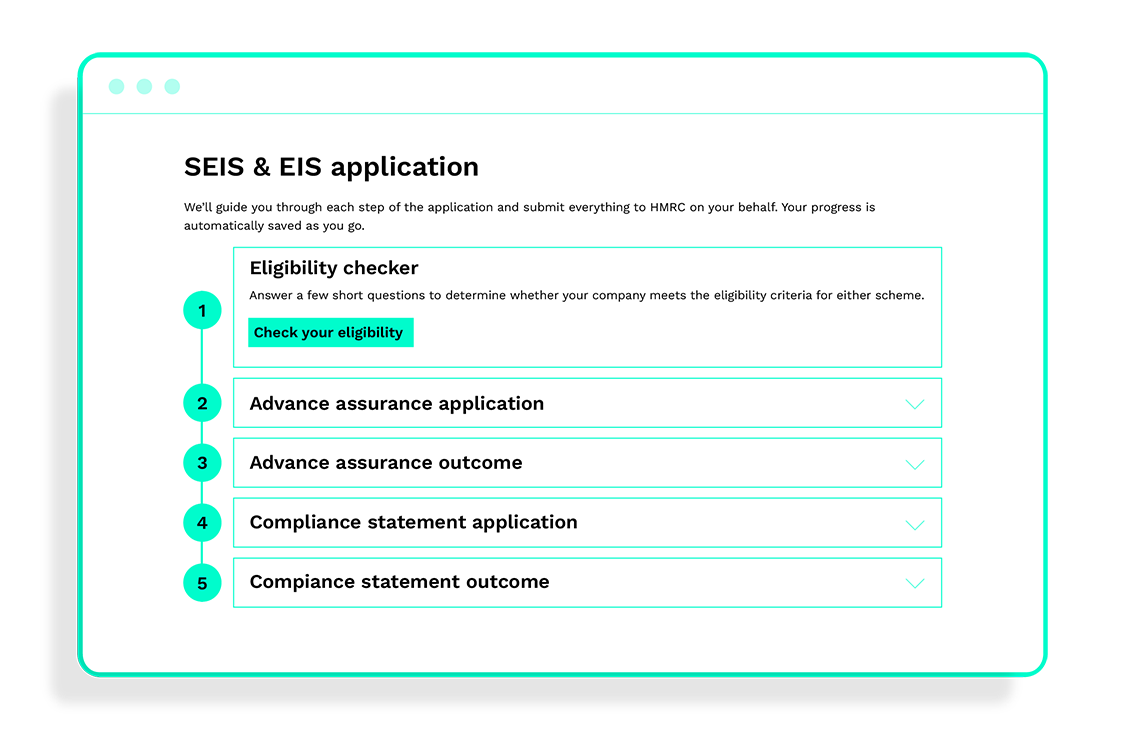

S/EIS Advance Assurance

Check your eligibility and apply seamlessly in-app. Once you’ve raised funds, submit your compliance statements right there—we’ll handle all correspondence with HMRC for you.

Companies House integration

Easily update shareholder records and automatically file with Companies House — keeping your cap table accurate, compliant, and always up to date.

Round modelling

Explore future value scenarios with our investment modelling tools.

Data rooms

Share key documents with prospective investors via a secure digital vault.

Investment docs

InVestd Raise includes all the investment agreements needed to execute your round — including a term sheet, Advance Subscription Agreement, or convertible loan note.

66 Days to Success is Back!

Our London Business Accelerator returns this October after a hugely successful first run.

Get expert workshops, priceless mentorship, and join a powerful founder community - all at zero cost!

66 days. Real momentum. 100% free.

Next step after InVestd Raise?

Motivate your team, boost retention, and scale smarter with Vestd.

Create EMI schemes, growth shares, and tailored vesting plans - all on Vestd's digital platform.

Our FCA-regulated platform is fully integrated with Companies House, so you can oversee shareholdings and stay compliant.

No paperwork, no hassle.

Schedule a free consultation to find out more.

Trusted by thousands of companies

Pricing

InVestd Raise is an add-on. Choose a plan (from £25 / mo) and upgrade.

Raise as much as you need, and keep all of it.

Pay monthly

£150 / mo

- 12 month contract

- No completion fee

- No engagement fee

- No upfront fees

Pay annually

£1,500

- Get two months free

- No completion fee

- No engagement fee

So how much will I save?

Typically thousands, compared to other fundraising platforms.

Let's compare InVestd Raise with SeedLegals...

Raise £250,000

SeedLegals charges £3,400, which includes a £2,000 fee based on 1% of the round size.

Save £2,249 with InVestd.

Raise £1,200,000

SeedLegals charges £8,899, which includes a £7,900 cut of the round.

Save £7,649 with InVestd.

Ready for the ride?

We're here to answer any questions about the fundraising process.

Book a free 30-minute video call with one of our experts.

Roll-Up Vehicles (RUVs) made simple with Vestd

Multiple investors? Our SPV Service makes it easy to create and manage Roll-Up Vehicles (RUVs), so you can streamline administration, and keep your cap table tidy.

Using Vestd's RUVs, your business can:

- Group investor names into a single line on your cap table - keep things clean and simple.

- Stay SEIS/EIS compliant - our setup ensures you don’t jeopardise eligibility.

- Manage the process end to end - KYC checks, investor dashboards, data rooms, and e-signatures all handled through the platform.

- Use the nominee structure - Vestd acts as nominee, holding shares on behalf of investors while they retain full economic rights.

Chat to us about setting up an RUV.

Want the ultimate fundraising playbook?

Not sure where to start with investment documents? Struggling to craft the perfect pitch deck? Wondering how to secure SEIS/EIS advance assurance? We’ve got you covered.

Download our free Founder's Guide to Fundraising for insights, tips, and strategies to execute your next raise with confidence.

Frequently asked questions

-

What makes InVestd Raise different from other fundraising packages?

With InVestd Raise, you get all the tools and expert support you need to complete a funding round for a flat fee of £1,250 - with no surprise cuts from your raise. It’s everything you need, with nothing you don’t.

-

Why should I use InVestd Raise for my SEIS/EIS application?

We will take you through every step of the SEIS/EIS process. From completing your Advance Assurance application, authorising and issuing your S/EIS shares, and the all-important Compliance Statement, your S/EIS journey is streamlined in-app. Oh - and we handle all HMRC correspondence, so you can focus on the important things. Easy, smooth, simple.

-

How does Vestd’s investment modelling tool work?

Our tool calculates ownership splits, potential dilution, and provides full transparency so you know how your rounds will impact your shareholdings.

-

How can I trial the platform?

Simply book a free consultation to discuss your needs, explore our features, and see firsthand exactly how InVestd Raise can streamline your fundraising process. Plus, try it out yourself with our free plan—no commitment needed!

-

What is special about managing my cap table with InVestd Raise?

Vestd tracks ownership, lets you update shareholder records, and automatically feeds the changes through to Companies House with our unique two-way integration. No messy paperwork - stay compliant in just a few clicks.

-

Do the legal docs cover everything for my round?

We’ve got you covered with everything from Term Sheets to ASAs (SAFEs), plus a custom Vestd Investment Agreement—letting you complete your round seamlessly without the hefty lawyer fees.

-

Why should I issue investor shares with InVestd?

With Vestd’s two-way Companies House integration, issuing shares whilst remaining compliant is a breeze.

-

Can I use InVestd Raise if I'm not ready to raise funds just yet?

100%. Get your documents together, clean up your cap table, and model future rounds so when the time comes, you’re set to go.

-

How does InVestd make life easier for early-stage founders?

InVestd takes the hassle out of the admin and compliance work so you can focus on pitching, growing, and building relationships instead of drowning in paperwork.

-

Where can I connect with other founders?

Our HelpBnk community is coming soon! By joining the waitlist, you’ll get exclusive insights, support, resources, and access to a community of fellow founders, plus early access to events designed to help your business grow.

-

What is the 66 Days to Business Success accelerator?

Over 66 days, our free programme guides you step-by-step through preparing, structuring, and managing your fundraising journey with ease. You’ll benefit from expert-led sessions and hands-on workshops, connect in-person with peers, and access a vibrant founder community.

The best part? It’s completely free!

Find out more here.

-

Can you match me with investors?

No - we don’t offer investor matching. Instead, our focus is on helping you become investor-ready, providing tools, resources, and support to manage your fundraise efficiently. That way, when you connect with investors, you’ll be fully prepared and confident.

You can also manage ownership and easily issue investor shares at the click of a button with Vestd - what’s not to love?

-

What comes after my first raise?

After your first fundraise, setting up share schemes is a key way to attract and retain top talent while motivating your team to grow the business.

With Vestd, you can issue shares at the click of a button, customise schemes to fit your business, and set vesting schedules effortlessly. This keeps your team incentivised and ensures your company structure stays clear, compliant, and ready for growth.

-

Do you provide investment document templates?

Absolutely. InVestd Raise offers a full suite of bespoke investment document templates! With our auto-generation tools, you can quickly produce investor-ready documents, saving time, reducing legal costs, and streamlining your fundraising process.